Team Citrine

Comprehensive Wealth Management & Financial Planning Services

Wealth Management

Financial & Tax Planning

Equity Compensation & Startup Planning

Our Investment Philosophy

1) Embrace Market Pricing

Financial science has taught us that the market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers - and the real-time information they bring helps set prices.

2) Don’t Try to Outguess the Market

The market’s pricing power works against stock pickers and market timers: Only 17% of US-domiciled funds beat their benchmarks over the past 20 years. In contrast, by using information in prices, 84% of Dimensional funds have beaten their benchmarks in that time.

3) Resist Chasing Past Performance

Some investors select funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. For example, most funds in the top 25% of previous five-year returns did not maintain a top-25% ranking in the following five years.

4) Let Markets Work for You

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and the stock and bond markets have provided growth of wealth that has more than offset inflation, as this chart of the past 50 years shows.

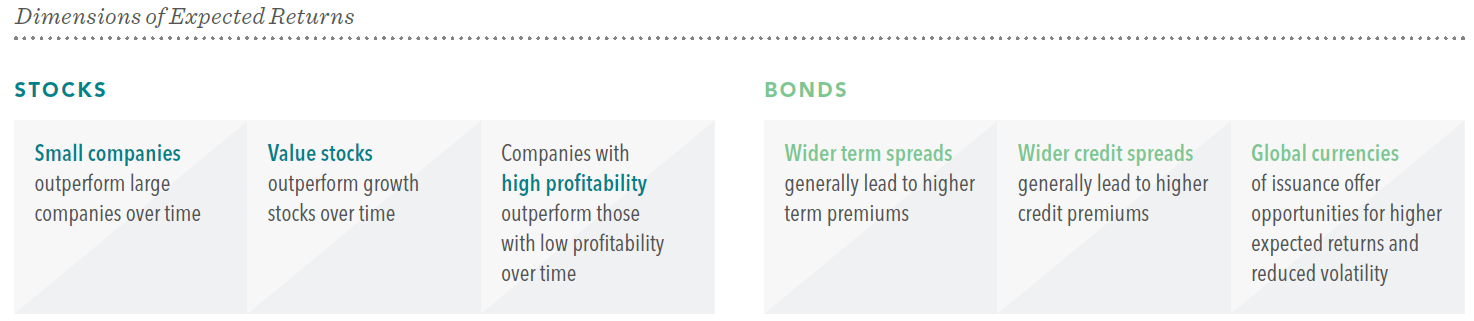

5) Target Higher Returns

Academic research into decades of stock and bond returns has identified long-term drivers of outperformance. By investing systematically in the areas with higher expected returns, you can aim to beat the market.

6) Diversify Internationally

Holding a globally diversified portfolio can broaden your opportunities beyond your home market - putting you in a better position to capture higher returns wherever they appear.

7) Avoid Market Timing

Research has shown there's no reliable way to time the market - targeting the best days to be invested or moving to the sidelines to avoid the worst days. It has also shown the impact of being out of the market even for a short time. Staying invested helps ensure you’re in position to capture long-term gains.

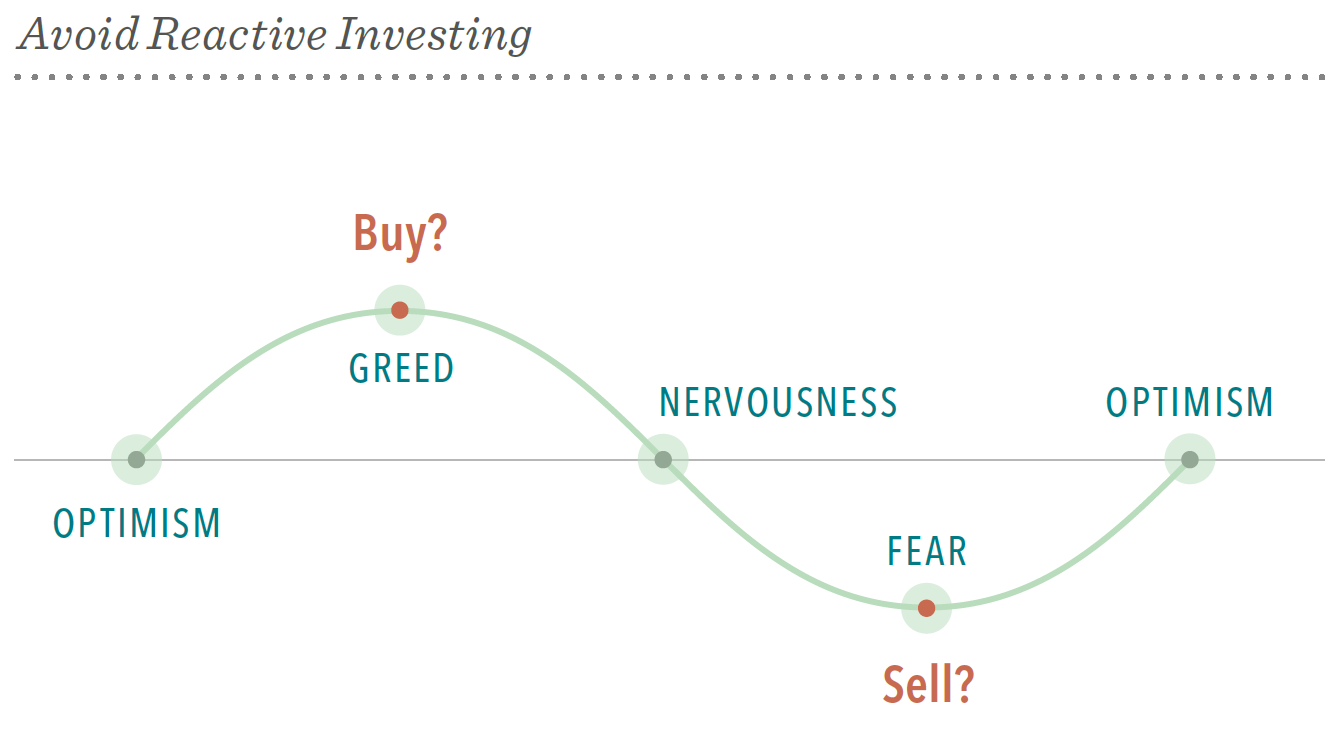

8) Manage Your Emotions

When markets go up and down, many people struggle to separate their emotions from investing. Reacting to current market conditions may lead to making poor investment decisions.

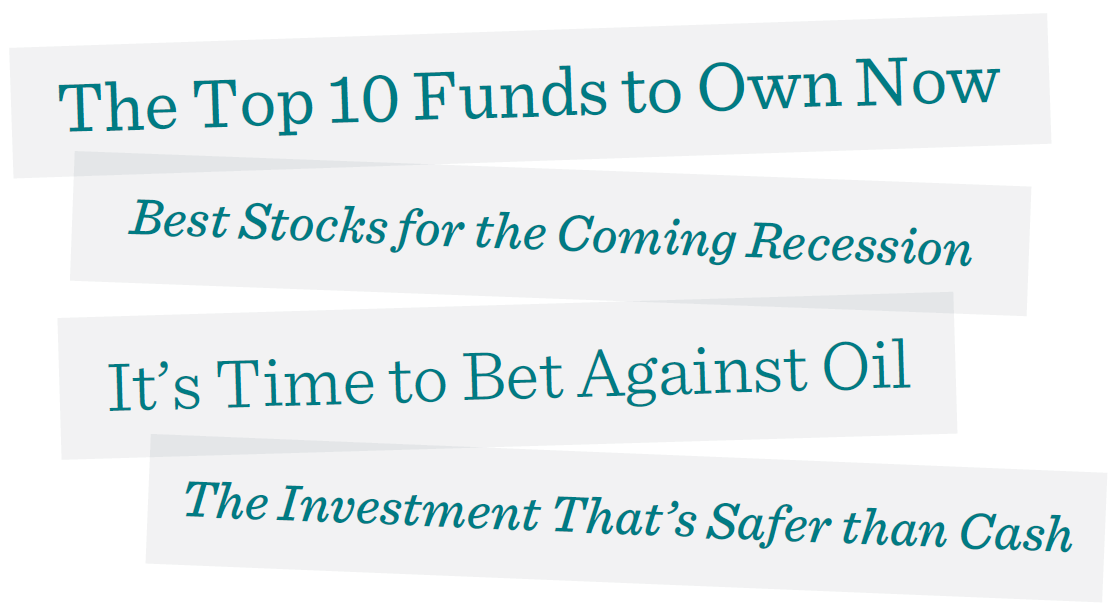

9) Look Beyond the Headlines

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source - is it news or entertainment? Do yourself a favor and tune out the noise.

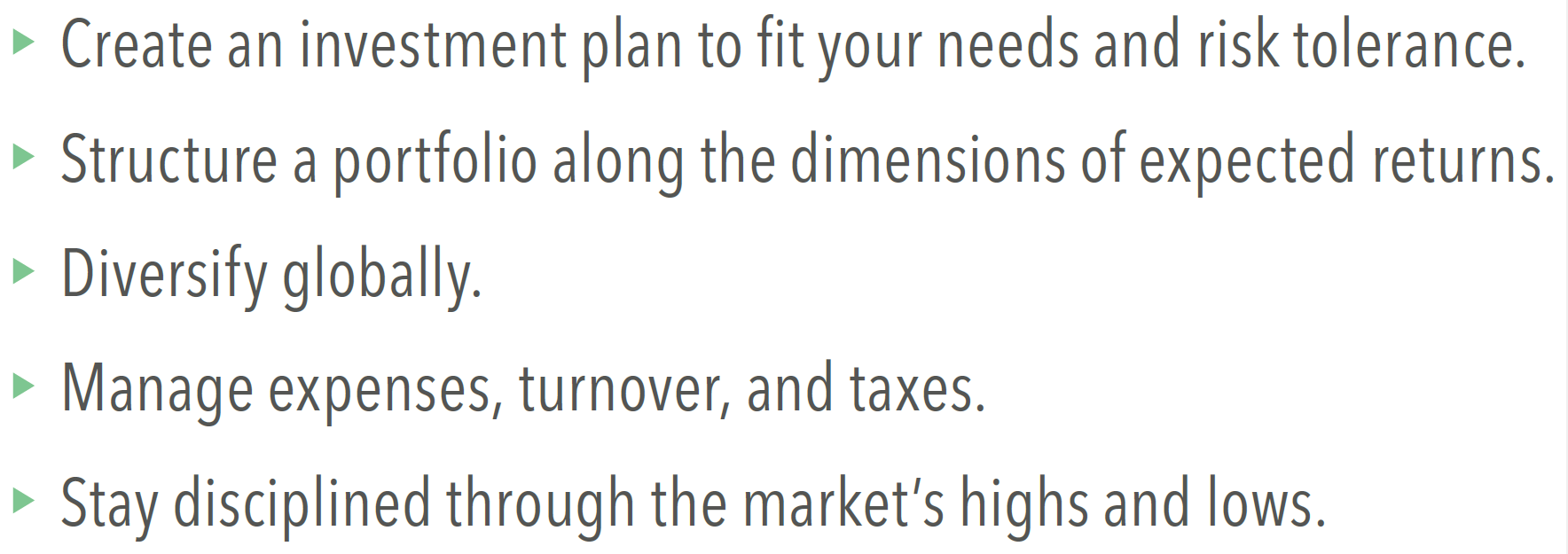

10) Control What You Can Control

Work with your financial advisor to stay focused on actions that add value. While you can’t control which way the market will turn, following time-tested principles can lead to a better investment experience.

Disclosures: Past performance is no guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. This information is for illustrative purposes only.

Click here for additional disclosures.

Our Process

Our comprehensive approach to wealth management focuses on the four cornerstones that are essential to the creation and conservation of wealth: asset protection, cash flow optimization, asset growth, and tax mitigation.