CARES Act - Q&A about Recovery Rebates, Student Loans, Health Care & Charitable Contributions

In the wake of the historic $2 trillion stimulus bill that Congress and President Trump have enacted in response to the COVID-19 pandemic, we’d like to help you understand how the provisions of the bill may affect you.

How much money will I actually get?

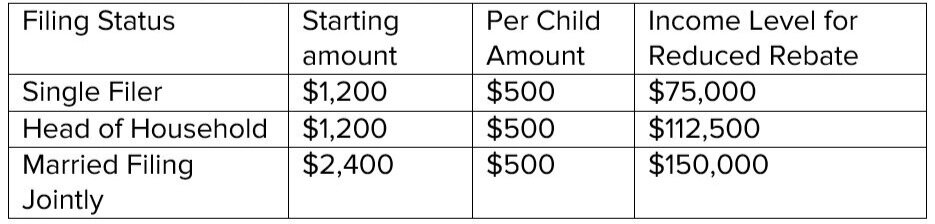

Eligible single tax filers will receive up to $1,200 and couples filing jointly will receive up to $2,400, plus $500 per dependent child under age 17. Your rebate amount may be reduced based on your income.

What do the income limits mean?

For every $100 of adjusted gross income above the income limit, you will receive $5 less than the maximum rebate. If your income is too high (see chart below), you will not receive a rebate.

How is my income determined for the rebate?

The income limit is based on your adjusted gross income in 2018 or 2019. If your 2019 income was lower than your 2018 taxes, you may want to hurry up and file your 2019 return to use your 2019 income as your effective income level.

I made lots of money in 2018 and 2019, but 2020 is not looking so good. Shouldn’t the rebate check amount be based on 2020 income?

If your 2020 income turns out to be less than the income limits, you will receive a tax credit later when you file your 2020 tax return. Be aware that you won’t receive the credit until 2021 in this case.

If the reverse happens and you end up making more money than the income limits in 2020, you still get to keep the money that you receive this year.

Will I owe taxes on my rebate check?

No, the rebates are tax free.

How will I receive my rebate check?

IRS will issue the rebate checks in one of three ways:

Direct deposit to the bank account you previously authorized the IRS to send your refunds

By mail to the address on your most recent tax filing

By mail to the address where you receive your Social Security payment, if applicable

If your address has changed, please download and complete IRS Change of Address Form 8822 immediately to ensure that you receive your payment.

When should I expect my rebate check?

The Treasury Department has announced that it plans to start sending the rebates asap, but we suspect that the first recipients will see their checks in early May.

Is there any relief for student loan borrowers?

Yes, you can defer payments of federal student loans with no accrued interest until September 30, 2020. If you want to stop the payments during this time, you will have to proactively call your lender.

The new law also allows your employer to exclude student loan repayments from your compensation.

Are there any health-care provisions?

The definition of qualifying medical expenses has expanded for HSAs, Archer MSAs and FSAs to include over the Over-The-Counter (OTC) medication and menstrual care products. Telehealth services are temporarily covered under HSA-eligible plans, so you can stay home and still consult with your doctor.

What about charitable donations?

For charitably inclined individuals, there is a new tax provision that allows you take a $300 “above-the-line” charitable tax deduction for cash donations even if you cannot itemize because you take the standard deduction. This will be treated as an adjustment to gross income on the tax return.

Taxpayers who itemize can now make charitable deductions up to 100% of AGI (up from 60% of AGI) as long as the cash contributions are made directly to a 501(c)(3) charity.

Is it true that tax filing dates have been postponed?

Yes, the April 15, 2020 tax filing and payment due date has been automatically postponed to July 15, 2020 for individuals, trusts, estates and unincorporated businesses. You do not need to file an extension and there will be no penalties or accrued interest until after July 15, 2020.

If you’d like to use this time invest in your long-term financial well-being, check out our website to learn more about Citrine Capital. If you think we may be what you are looking for, complete our introduction request form and we’ll get back to you promptly.