The Debasement Trade: Is This the Beginning of the Great Currency Exodus?

JPMorgan analysts have coined a term that's resonating across Wall Street: the "debasement trade." They're spotlighting gold and bitcoin as the go-to assets for investors fleeing the steady dilution of fiat currencies. As the bank puts it, this trade captures a cocktail of worries - from geopolitical jitters and policy chaos to ballooning deficits, doubts about Fed independence, and a global pivot away from the U.S. dollar. It's not just theory; institutional money is pouring into bitcoin and gold ETFs, pushing prices to new highs and signaling a broader shift in how the "smart money" is positioning itself.

Unpacking Currency Debasement: The Death of the Measuring Stick

For years, governments worldwide have been cranking up the money printer to fund endless spending sprees. But what exactly is debasement, and why should you care?

At its core, debasement is the erosion of a currency's purchasing power - think more dollars chasing the same (or fewer) goods. Here's how it's happening:

Government Overspending & Monetary Expansion

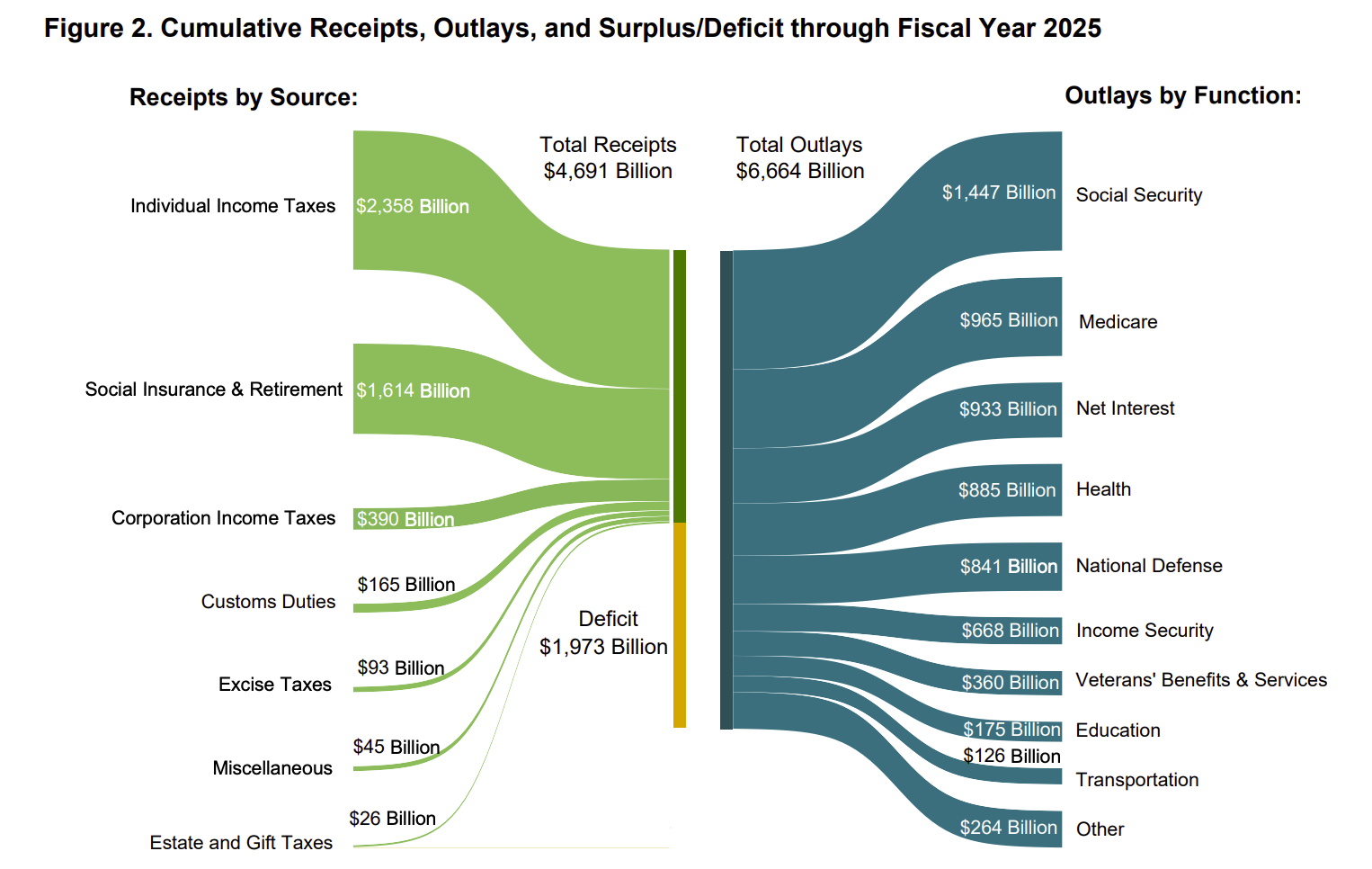

Politicians love big promises, but when tax revenues fall short, central banks step in with freshly minted money. The U.S. deficit hit $1.8 trillion in 2024 alone, financed largely through Treasury issuance. We are now seeing fiscal gaps of 6-8% of GDP, which is unheard of outside of wartime. The result is more dollars/liquidity in the system.

Negative Real Rates & Financial Repression

When official interest rates lag behind true inflation, cash and bonds become losing bets. Treasuries yielding 4% while actual inflation is above 4% (we’ll explain this below) is a stealth tax on savers that quietly transfers purchasing power from bond holders to the state.

Credit Booms from Loose Lending

Banks extend more loans in low-rate environments, inflating asset bubbles and driving up prices across the board. Federal debt is now over 120% of GDP, and household and corporate debt are also at all-time highs. And with interest rates predicted to come down, we should see increased lending going forward.

Bail Outs

Crises like the 2008 Global Financial Crisis, the 2020 COVID meltdown, and the 2023 Bank Term Funding Program (BTFP) saw trillions in printed liquidity propping up the economy. Each rescue injected massive amounts of liquidity into the economy, which ultimately further debased the currency.

Luke Gromen’s Chart: Asset Performance in Various Denominators (S&P 500, Gold, Bitcoin, USD)

Dollars, and other leading currencies, are losing value faster than most people realize. Measuring assets in USD can be misleading, as it masks the underlying erosion. The below illustration highlights how traditional assets like the S&P 500 perform when denominated in alternatives like gold or bitcoin - often revealing a starkly different picture.

So, the underlying question is, are we in a bull market, or are we dealing with a faulty denominator and a failure of the measuring stick? If you’re measuring in dollar terms, then US markets look euphoric. Since the beginning of COVID, the housing market is up 56% even while interest rates have risen. During the same period, the S&P 500 is up 102% and the NASDAQ is up 165%. However, if we use gold as the denominator, then the housing market is down 37%, the S&P 500 is down 18% and the NASDAQ is up only 7%. If you use bitcoin as your denominator, then everything is down between 78% and 87%.

Growth, or a Collapsing Unit of Account?

The government's Consumer Price Index (CPI) is the official yardstick, clocking in at an average annual rate of about 4.2% per year from 2020 to today. But many argue this understates the true bite of inflation, especially since it's tailored to a basket that doesn't match most people’s spending habits.

For a better proxy, look to gold, due to its relatively finite supply and history as a monetary asset. Gold's price has delivered an average annual return of about 24.51% from 2020 to today, reflecting its role as an inflation hedge. Similarly, M2 money supply - a measure of cash and near-cash in the economy - has grown at an average annual rate of roughly 6.74% over the same period. These alternative measuring sticks are not perfect, but they suggest that inflation is much higher than the official numbers. This mismatch shows why housing, your grocery bills, and health care costs feel heavier than the headlines suggest.

Today, it seems like everything is skyrocketing - this includes stocks, real estate, and even collectibles. But is it real growth, or is the denominator a slowly melting ice cube? We believe we are witnessing a "melt-up" in asset prices, fueled by debasement, where nominal gains are obfuscating real losses in purchasing power.

How to Take Advantage

So where does all the excess money end up? Simply put, it ends up in assets. Money printing and increased global liquidity benefits housing, stocks, and especially hard assets (defined as assets that are very difficult, or impossible, to debase) like gold and bitcoin and other scarce commodities.

Bitcoin & Gold: Core of the Debasement Trade

Both offer scarcity in a sea of printed fiat. Expect volatility, but they should continue to outperform.

Commodities: Tangible Value in Weakening Fiat

Things like silver, copper, and oil - tangible goods that hold value as currencies weaken.

Stocks, Real Estate and Bonds: Roles & Risks

Equity allocations are important, especially in innovative or resource-driven sectors. Real Estate will not perform as well as stocks or hard assets, however, on average, it should at least keep close to the real rate of inflation.

There will be corrections along the way, but we anticipate these assets to continue performing over the next five to ten years. There will be volatility, and it’s best to take advantage of this to buy the dips.

And what about bonds? They have roles in diversified portfolios, gaining on paper but often losing real value. Hold them tactically if you will be needing cash in the next few years or simply to reduce the overall volatility of your portfolio.

In sum, the debasement trade isn't just a fad; it's a response to systemic flaws. As governments keep spending like there's no tomorrow, savvy investors are taking advantage today. Stay informed, diversify wisely, and remember: in a world of fiat flux, true wealth preservation demands looking beyond the dollar.

About The Author

Ryan Sterling Cole, CFP® is a co-founder and managing director of Citrine Capital, a San Francisco-based wealth management and tax planning firm serving tech professionals, founders, and business owners. Through his studies and over 20 years of investment experience, Ryan became a firm believer in tax-efficient investing and low-cost portfolio management. His financial know-how eventually led him to be a resource for friends and family, and he quickly discovered his passion for helping others with financial planning and investing. Ryan specializes in equity compensation, taxation, and financial independence.