How to Value Bitcoin: Key Valuation Models Explained

Understanding Bitcoin's Unique Value Proposition

Bitcoin challenges conventional finance. It has no cash flows, earnings, or CEO. Yet its market cap has surpassed $2 trillion, and investors still ask: How do you value something so unique? At Citrine Capital, we take a first-principles approach to valuing bitcoin rather than following the hype cycles. Whether you're a committed Bitcoin holder or just curious, this guide explores the key frameworks for understanding Bitcoin’s value in 2025 and beyond.

Why Does Bitcoin Have Value?

Traditional finance struggles to explain Bitcoin. It’s not backed by governments, a central bank, or tangible assets - yet it offers something no other asset can: digital scarcity, global accessibility, censorship resistance, and monetary neutrality. All of this is enforced by math, not trust. Its value emerges from network consensus, economic incentives, and game theory. Like the internet in the early 1990s, Bitcoin’s significance requires a deeper look; there’s no single “right” valuation model. This post provides tools to understand its value and assess how it fits into a modern portfolio.

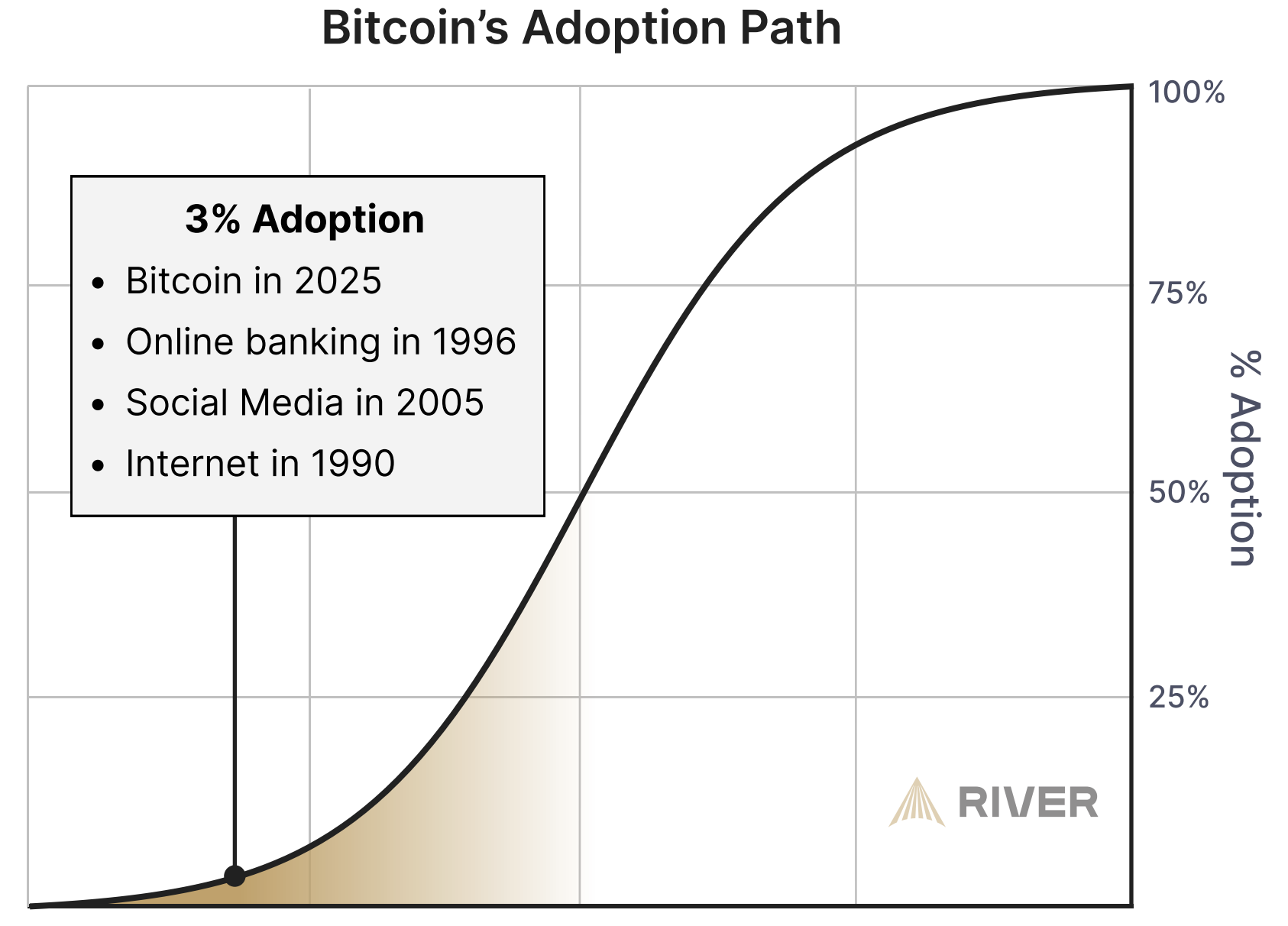

X-axis displays time. Calculated using a combination of total addressable market, institutional under allocation, and global ownership, Bitcoin adoption in 2025 is at roughly 3% of its full potential.[1]

Metcalfe’s Law: Network Value and Adoption

Bitcoin is a decentralized monetary network. As more users join - retail investors, institutions, and even sovereigns - the network becomes more useful and valuable. This dynamic is often modeled by Metcalfe’s Law, which suggests that a network’s value is proportional to the square of the number of participants.

Like the internet in its early days, Bitcoin’s value grows exponentially as adoption increases. In the 1990s, each new internet user expanded the number of possible interactions - driving explosive growth in utility and economic value. Bitcoin follows the same pattern: as more people, businesses, and governments join, the potential value it can support expands far faster than its user count.

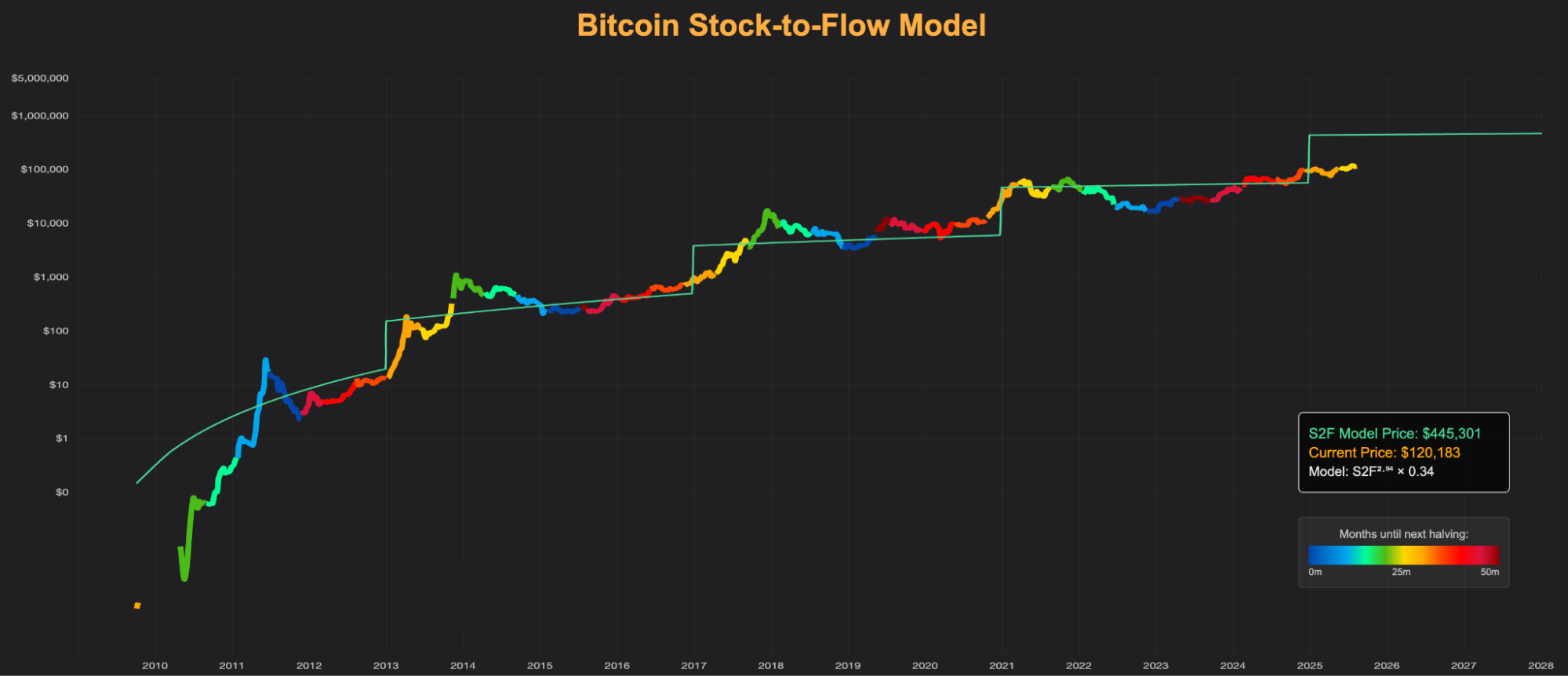

Stock-to-Flow: Assessing Bitcoin's Scarcity

Bitcoin’s hard cap of 21 million coins makes it the only asset with a provable, fixed supply. Its scarcity is unique: even as demand rises sharply, no amount of mining power or technological innovation can increase the total supply beyond that limit.

The Stock-to-Flow (S2F) model measures the relationship between Bitcoin’s existing supply (“stock”) and the rate of new issuance (“flow”). Assets with a higher stock-to-flow ratio - meaning their existing supply greatly outweighs their new supply - tend to be more effective at holding value over time.

While it’s not a precise price prediction tool, it illustrates how Bitcoin’s scarcity is enforced at the protocol level - and why that scarcity becomes more compelling as a durable store of value.

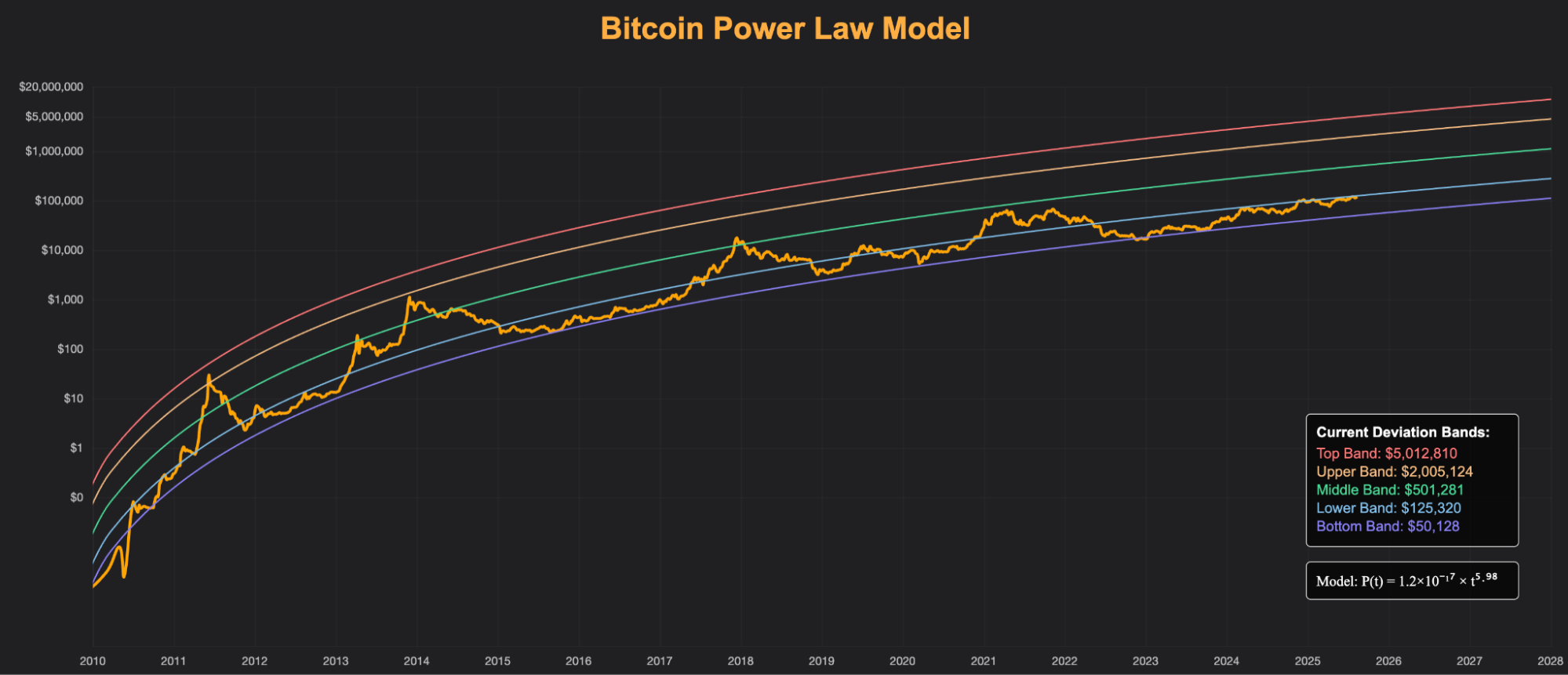

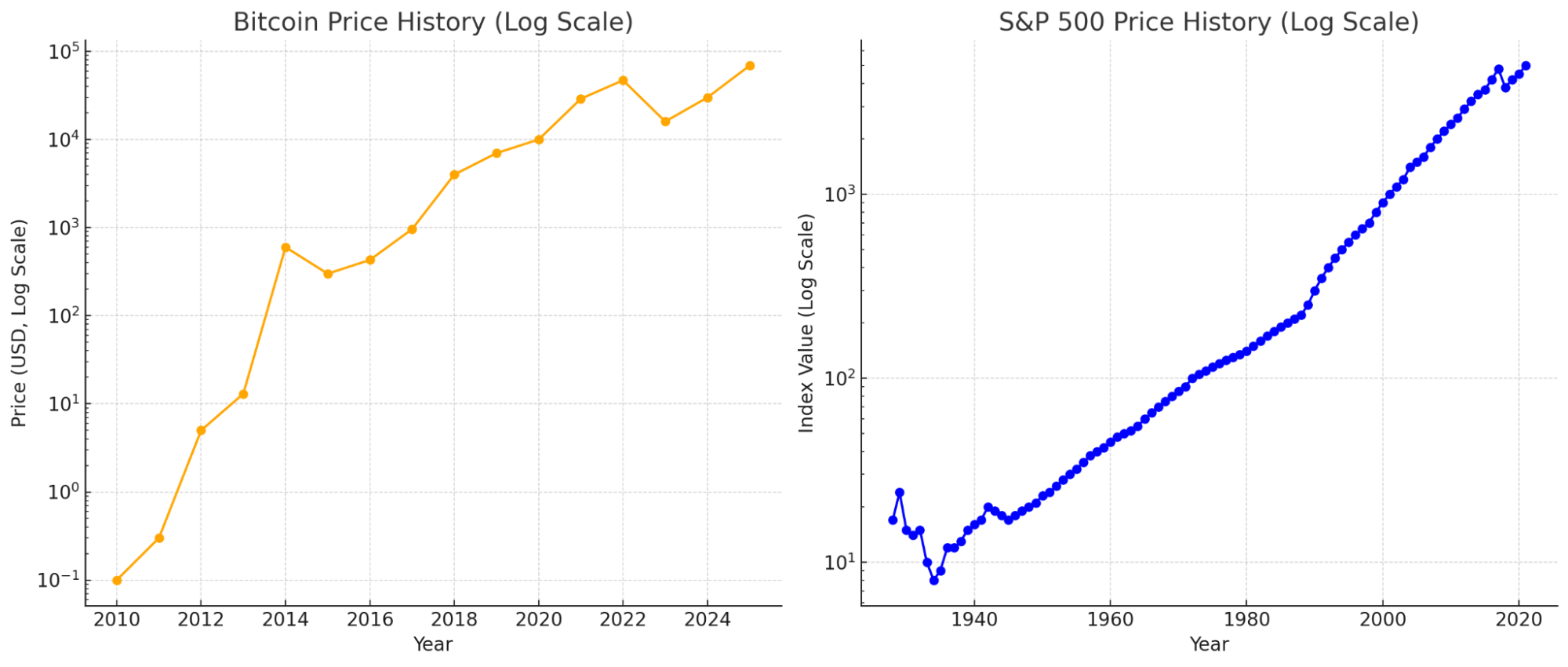

The Bitcoin Power Law: Mapping Long-Term Growth Trajectory

The Bitcoin Power Law offers a different lens - suggesting that Bitcoin’s long-term price follows a logarithmic growth curve, modeled using a power law distribution rather than a linear or exponential one. Plotted on a log-log chart (with both price and time on logarithmic axes), Bitcoin has consistently moved with an upward-sloping channel since its inception - regardless of short-term volatility or macro shocks.

How this differs from the S&P 500’s long-term trend:

The S&P 500 has risen over decades because its underlying companies generated earnings, grew productivity, and benefited from inflation.

Bitcoin has no earnings, dividends, or corporate fundamentals. The upward channel is explained instead by monetization and adoption - a once-in-history process where a monetary good transitions from near-zero market share to potentially global-scale usage.

The power law implies Bitcoin is undergoing a gradual monetization process, much like gold in antiquity. While Bitcoin may overshoot or undershoot the curve in the short term, it has historically reverted to the mean over time. This model has remained remarkably consistent - even through black swan events and shifting macro conditions.

On-Chain Metrics: Transparency as a Valuation Tool

Unlike traditional financial assets, Bitcoin’s ledger is fully transparent - which means anyone can analyze real-time data directly from the blockchain.

On-chain metrics help us assess sentiment, capital flows, and investor behavior. Key indicators include:

Realized Price: The average cost basis of all coins, useful for understanding capital invested in the network

MVRV Ratio (Market Value / Realized Value): Compares market value to realized value - often used to identify potential overvaluation or accumulation zones

HODL Waves: Visualize how long coins have been held, signaling long-term conviction or short-term speculation

These tools help us filter signal from noise - grounding Bitcoin valuation in observable behavior, not just market narratives.

Production Cost Model: Analyzing Mining Economics

Another way to assess Bitcoin’s value is by examining its cost of production - what it takes to mine one new Bitcoin. This includes:

Electricity consumption

Mining hardware and depreciation

Labor, infrastructure, and operational costs

This is significant because Bitcoin has shown strong price support around its estimated current production cost. For example, during the 2022-2023 bear market, Bitcoin rarely dipped below the $15,000-$20,000 range - widely seen as the breakeven point for miners at the time.

While better hardware can lower costs for miners, Bitcoin’s difficulty adjustment offsets these gains. As efficiency and total network hash rate (computing power) rise, the protocol makes blocks harder to find, increasing total energy use across the network. Over time, this pushes up the all-in cost of production, creating a moving price floor that often anchors long-term valuation during periods of market stress.

Bitcoin vs. Gold: A Modern Store of Value

Bitcoin is often referred to as “digital gold” - but it’s more portable, divisible, programmable, and verifiable than its analog predecessor.

Today, Bitcoin has begun to capture gold’s market value, and institutional adoption is still in its early stages. If Bitcoin reaches full parity with gold, its price could rise approximately 9x or more from current levels - making this comparison a useful benchmark for long-term valuation.[2]

Gold’s market cap (2025): ~$23 trillion

Bitcoin’s market cap: ~$2.3 trillion

Implied gold parity price: ~$1,167,000 per Bitcoin

Valuation Scenarios: What Could Bitcoin Be Worth?

While Bitcoin’s supply is fixed, its potential demand is highly elastic - especially as institutional and sovereign adoption grows.

One way to estimate long-term value is by modeling what happens if larger pools of global capital allocate even a small percentage to Bitcoin.

Below are four directional scenarios based on realistic capital inflows:

BTC Price Scenarios by Capital Inflow

Scenarios showing implied Bitcoin price given different capital inflows and allocation assumptions.

Scenario

Hypothetical Bitcoin Allocation

Capital Inflow

Implied Bitcoin Price[3]

Institutional Capital[4]

1%

$847 billion

$162,618

Institutional Capital

5%

$4.2 trillion

$332,822

Global Wealth[5]

1%

$9.1 trillion

$579,542

Global Wealth

5%

$45 trillion

$2.4 million

| Scenario | Hypothetical Bitcoin Allocation | Capital Inflow | Implied Bitcoin Price[3] |

|---|---|---|---|

| Institutional Capital[4] | 1% | $847 billion | $162,618 |

| Institutional Capital | 5% | $4.2 trillion | $332,822 |

| Global Wealth[5] | 1% | $9.1 trillion | $579,542 |

| Global Wealth | 5% | $45 trillion | $2.4 million |

These aren’t short-term forecasts - they’re valuation ranges that illustrate what could happen as Bitcoin becomes a more mainstream asset in portfolios and global wealth allocations.

Total Addressable Market (TAM): Beyond Gold

Bitcoin’s potential value doesn’t stop at matching gold. It could also absorb part of the “monetary premium” in other global asset classes - the portion of their value that comes not from direct utility, but from their role as a store of value. For example, prime real estate, long-term government bonds, and even cash reserves often trade above their functional worth because investors use them to preserve their wealth.

Bitcoin’s total addressable market includes roles such as:

When you account for Bitcoin’s ability to serve multiple monetary functions simultaneously, the upside expands well beyond comparisons to gold alone - especially if capital currently held in real estate, bonds, and cash begins to reallocate toward digitally native assets.

Bitcoin Energy Value Equivalence

Some analysts propose that Bitcoin should be viewed not just as a financial asset, but as a form of digital energy. This framework values Bitcoin relative to global energy markets by considering:

The cost of production

The energy required to secure and maintain the network

Bitcoin’s role as a figurative battery for surplus economic energy - where excess electricity can be converted into Bitcoin via mining, preserving its monetary value across time and space.

Framing Bitcoin in terms of energy consumption and conversion highlights its physical grounding and economic utility - especially in a world where energy is the foundation of all productive systems. It also reinforces that Bitcoin's value is not abstract, but anchored in proof-of-work and thermodynamic cost.

Valuation Is a Long-Term Lens, Not a Price Target

Bitcoin’s volatility has deterred many - but we see it as the natural process of price discovery for a new global asset undergoing long-term monetization.

It’s also important to acknowledge that no single valuation model is infallible. Frameworks based on scarcity, adoption, or institutional flows are just that - frameworks, not forecasts. And with a revolutionary technology like Bitcoin, even the best models can break.

A first-principles approach is essential. Rather than chasing hype cycles, thoughtful Bitcoin planning means:

Building strategic portfolio allocations

Optimizing for cash flow, liquidity, and risk tolerance

Ensuring secure custody and asset protection

Planning for tax-efficiency and wealth transfer

Conclusion

Valuing Bitcoin requires a shift in mindset - from traditional financial metrics to a network-driven, scarcity-based framework that reflects its unique role in a changing monetary landscape.

At Citrine Capital, we help clients integrate Bitcoin thoughtfully and strategically. It’s not just about what Bitcoin is worth today - it's about what it could mean for your financial future.

Noted Sources:

[1] The Nakamoto Project, River.

[2] Calculation based on gold’s estimated total above-ground value of $23.23 trillion and Bitcoin’s circulating supply of ~19.9 million. $23.23T÷19.9M≈$1.167M per Bitcoin. This represents roughly a 9.7x increase from Bitcoin’s current market cap of $2.39T

[3] Implied Bitcoin Price is calculated as: (Current Bitcoin Market Cap+Capital Inflow) / Circulating Bitcoin Supply.

Assumptions:

-Current Bitcoin Market Cap: $2.39 trillion

-Circulating Bitcoin Supply: 19,905,540 BTC

-Current Bitcoin Price: $120,104

For example, a $847 billion inflow into Bitcoin increases the market cap to $3.237 trillion. Dividing by the circulating supply gives an implied price of ~$162,618 per BTC.

[4] Institutional capital includes Pension Funds, Sovereign Wealth Funds, Hedge Funds, and Insurance Companies totaling $84.7 trillion.

[5] Global wealth includes real estate, bonds, money, equities, gold, art, and collectibles totaling $914 trillion.

About The Author

Jirayr Kembikian, CFP® is a wealth advisor, managing director and co-founder of Citrine Capital, a San Francisco-based wealth management and tax preparation firm serving tech professionals, founders, and business owners. He specializes in navigating the complexities of equity compensation, private investments, and Bitcoin wealth strategies. With over a decade of experience guiding clients through liquidity events and complex financial decisions, Jirayr brings a grounded yet forward-thinking perspective to building and preserving wealth.